Adrian Peterson broke and auctioning most of his possessions

One of the greatest running backs, and the highest paid running back of all-time is broke less than three years after retirement. He made over $100 million in contract money during his career, not including any endorsement deals. College coaches may want to bring this up when recruits are only concerned with a few hundred thousand NIL dollars.

Learn how to handle your money or you’ll go broke no matter how much you’ve got. You can bid on his Player of the Year awards and much more here.

February 23rd, 2024 at 12:18 AM ^

I always ask why. its almost like corporate america wants our people dumbed down....

February 23rd, 2024 at 10:12 AM ^

It really had nothing to do with corporate America, and everything to do with politics. At least in Chicago it is.

February 22nd, 2024 at 3:45 PM ^

$100 million contract = $10 mil for agent + $34 mil Federal Tax + $10 mil other taxes = $46 mil to him.

There are always people asking to "manage your money". Typically, they will clear out the athlete. Of course, the athlete has some responsibility in managing their finances, but they are most probably busy playing and conditioning to tackle that part.

Student-athletes need classes on both money and people management.

This is another reason, why Bobby Bonilla's contract is a great example of a forced retirement plan. Ohtani is doing something similar as well.

February 22nd, 2024 at 4:10 PM ^

I think the money management classes would have to include a class on how to spot people who don't have your best interest, like all the hangers on. Even after taxes and managers/agents, that amount is plenty to live a great life til the end. I don't know how you teach someone that they don't need a $25 mil mansion or ten Lamborghinis or whatever dumb and excessive material stuff floats their boat. You'd think the cautionary tales of the ones who came before would be enough.

February 23rd, 2024 at 1:13 AM ^

Hiring someone to manage their money is stupid though. They already won the life lottery, they don't need to 5x their wealth in one year with any off the wall investment. Even allowing idiocy with $26million of the total, it takes no effort, advice, or skills at all to dump $20 million into an indexed mutual fund and live on the $1.6 million per year that pays you.

February 23rd, 2024 at 7:02 AM ^

My niece works for a company that manages the assets for people that are Ultra High Net Worth Individuals. There are a lot of kids in America where their family made enormous money, e.g. Campbell (soup), DuPont, Mars (candy), etc.

These kids (many now old enough to get social security) have over $30M just to be a client. Her job is basically to manage their monthly allowance and make sure that they don't eat any of the principle. At $30M, they get an allowance of at least $1.2M / yr ($100k / month) and yet many of them are constantly asking for more. "Oh, I want to sell this house and buy this house. Or, I need to go to the South of France with my friends for a month. I'll take a cut the next month." It's amazing.

People like this don't need a manager to invest their money. They need a manager to keep them from blowing it.

February 22nd, 2024 at 4:41 PM ^

Unfortunately, education doesn't solve the problem. What players/people need is good, fiduciary advice and representation. Lots of these players have people taking advantage of them and while it's easy for us to say $100M should last forever, having the wrong people around you can drain any amount of money very quickly.

Mike Vick's story is a great example of this. His "financial advisor" was the driving force behind virtually every bad decision he made.

I have HUGE concerns about this with NIL. College kids are even more likely to get hoodwinked than pros.

February 22nd, 2024 at 5:52 PM ^

This has been one of my main issues with NIL. If you have teens or kids in their early 20's, chances are you've seen the kinds of financial decisions they could make if they had huge amounts of disposable income. This is why I'm glad my kid doesn't make a ton of dough! He's learning how to live on a budget and that's a great lesson.

February 22nd, 2024 at 5:28 PM ^

It's tough when you've never had money. From what I understand, people end up with a posse of hangers on that drain money until they're out.

I always thought it would make sense for the basic sports compensation to put 10% of the income into an "OJ Trust" - some kind of investment vehicle that will pay out an annuity forever and that creditors can't reach if you end up owing your casino/bank/former business partners $100M.

I'm not sure if that's legal, but if is, it's a good idea.

February 23rd, 2024 at 12:05 AM ^

in general, you're right, but no course on personal finance can save you from squandering $100 million. do you realize how much that is. it almost takes effort to spend that much. lotsa trips to disney

February 23rd, 2024 at 12:13 AM ^

Every HS student should. Understanding 40% wont care to listen but its a crime our public school system doesnt require this. Instead geometry which almost no one uses, or reading some literature from who knows where none of which is applicable in day to day life as knowing what amortization means, what "APR" means, how to finance a car, how to build credit, or hell balancing a "check book" (electronically) of course.

I get that "Civics" (or government) was the 1 class everyone had to take back in the day (and 40% couldnt tell you 3 branches of government) but at least they tried. Financial literacy is a lot more important than 90% of what is taught.

February 23rd, 2024 at 12:16 AM ^

yeah i 100% support requiring personal finance classes for anyone and everyone. but i maintain that no universal class, even if you get an A, will stop you spending AP money. you gotta really go hard to spend that much. no dave ramsey 5% mutual fund is gonna save you from this idiocy. it's one hundred dollars, a million times.

February 24th, 2024 at 8:51 AM ^

I think that the issue is that professional athletes never have a phase of their life where they are making a modest living and learn how to save and make ends meet. Where the average person typically earns the ir compensation towards the end of their career.

Professional athletes go from living with their parents or college to making a huge sum of money for a period of 1-5 years (typically). They don't have the necessity of learning how to budget and save. And since they earn the majority of their income in these handful of early years, they've blow what could have been their savings.

February 22nd, 2024 at 3:11 PM ^

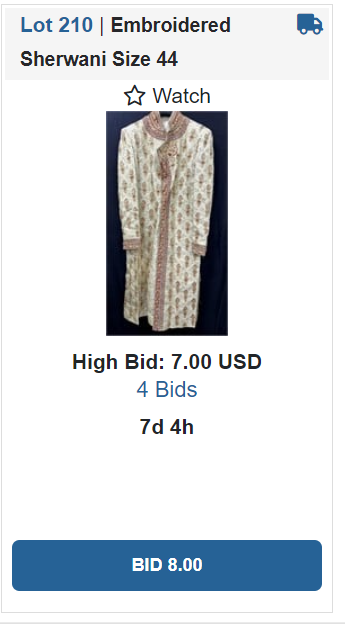

From this:

To this:

February 22nd, 2024 at 3:14 PM ^

I guess if he spent less than $7 on it originally, it counts as an investment?

February 22nd, 2024 at 7:34 PM ^

....and it will be taxed as a long term capital gain!

February 22nd, 2024 at 4:00 PM ^

I was already checking out the Sherwani, $7 is less than you can get one for on Devon. Thanks for the context!

February 22nd, 2024 at 4:11 PM ^

But if you got it in India, the $7 would also cover the cost of a teeth cleaning and probably a filling. Very cheap dental work can be found there.

February 22nd, 2024 at 4:37 PM ^

Looks like it's already up to $45, with 7 days left to go. I'm out - too bad, that would have been awesome.

February 22nd, 2024 at 7:36 PM ^

LOL, you must be a brown brother, or have lots of brown friends!

February 22nd, 2024 at 4:34 PM ^

Might as well take it to Goodwill....

February 22nd, 2024 at 3:11 PM ^

He is refuting selling any of his trophies for what its worth

February 22nd, 2024 at 3:18 PM ^

Oh, good. I'm glad to hear he has some integrity and sense of self-worth...

/s

February 22nd, 2024 at 3:22 PM ^

that username with that comment is just everything.

February 22nd, 2024 at 3:26 PM ^

I don’t know how to embed or upload pictures on mobile or I would, but they’re in that same auction with roughly 950+ other items including everything from grandfather clocks, Prada shoes, a custom leather chair with AP on it, etc. Making this Gif is the best I’ve got:

February 22nd, 2024 at 3:31 PM ^

And many, many game balls.

February 22nd, 2024 at 4:37 PM ^

And SI magazines.

February 22nd, 2024 at 3:38 PM ^

https://www.yahoo.com/entertainment/adrian-peterson-says-hes-not-175737235.html

"I want to clarify recent rumors and media reports,” the 38-year-old said in a video posted to X on Wednesday. “An estate sale company without my authorization included some of my trophies in a sale, despite clear instructions to leave personal items untouched. I did not authorize the sale of any of my trophies, and I will be taking legal action.”

"I want to emphasize that I am financially stable, and would never sell off my hard-earned trophies,” the 15-year NFL vet said.

“And if I was gonna sell them, I know people that I could sell them to,” Peterson said. “I wouldn’t go online and sell my personal items randomly. So let that sink in."

February 22nd, 2024 at 4:01 PM ^

"I want to emphasize that I am financially stable, and would never sell off my hard-earned trophies,” the 15-year NFL vet said.

So financial stability is keeping a hold onto your trophies but not the other 950+ personal memorabilia items? Weird flex, AP but I'm gonna have to call shenanigans.

February 22nd, 2024 at 3:21 PM ^

He compounded bad money decisions with more bad money decisions. It’s honestly sad to see.

Separate but related - We always hear the stat about +75% of NFL players going broke within a few years of retirement, but I wonder how much “school attended” makes a difference. Probably none, but it’d be one hell of a recruiting chip for whomever can best sell graduates long-term success w/ hard numbers.

February 22nd, 2024 at 3:31 PM ^

There was a few students in the Michigan Business school who started a business to manage player's money. I think this started ~15 years ago. I remember one of their first clients was a Michigan football player who got a big first round NFL contract and the Michigan Daily interviewed him. I remember him being told by them to act like this was the only contract he would get and to show him how to make it last his lifetime. It meant he was only getting yearly "salary" to start of ~$60,000, which he remembers thinking was crazy until they showed him how quickly it could all go. I don't like people being told what to do with their money, but so many people prey on these athletes who haven't been schooled in how to manage their money, that it is easy for them to lose it all.

February 22nd, 2024 at 3:53 PM ^

You also hear a decent amount of players who do not spend any of their contract and only live off endorsement money.

Sadly, I'm guessing a lot of the former players that lost all their money didn't blow all their money on ridiculous discretionary spending, but more likely were taken advantage of and lost it through unwise investments or outright theft/fraud

February 22nd, 2024 at 4:10 PM ^

For sure. They are easy prey for a lot of people. Family, Friends from their neighborhood. Grifters who promise them huge returns. I'm sure they want to be like Shark Tank and make lots of money. Owning a restaurant or bar always seems so cool, but I've seen plenty of shows about people losing tons of money on a restaurant. MTV cribs didn't help with people thinking they needed all these cars that were the exact same decked out cars as everyone else and huge homes.

Less fun to put money into an investment and live off the interest. Even there, there are plenty of people to steal your money if you don't know how to invest in a diverse portfolio (I don't know how to do it besides a simplified version on my 401K). So many ways and people there to take their money.

February 22nd, 2024 at 8:08 PM ^

Remember Sergei Fedorov got bilked for like 30MM?

February 22nd, 2024 at 3:21 PM ^

That is why the "We ain't here to play skool" crowd misses out. Plenty of stories like this, and it isn't just about having a financial education. You need to have the right temperament and attitude toward money. I always think of the parable of the ant and the grasshopper.

February 22nd, 2024 at 3:23 PM ^

Too bad he only had a transactional experience in college.

February 22nd, 2024 at 3:28 PM ^

Anyone remember J.R. Richard (Houston Astros great) living under an overpass? He was able to get things righted after hitting rock-bottom. May Peterson find a similar path.

February 22nd, 2024 at 4:02 PM ^

J.R. Richard may not have managed his money well, but he had a significant medical issue at a young age that surely altered his trajectory:

https://en.wikipedia.org/wiki/J._R._Richard

If I'm drawing parallels to AP, I'm probably choosing someone else.

February 22nd, 2024 at 8:03 PM ^

Well, fine. But, as your link states, "unsuccessful business deals and...two divorces" liquidated what was no small amount of assets he obtained during several years as an absolutely dominant pitcher.

February 22nd, 2024 at 3:33 PM ^

The lesson is not, NIL isn't much; the lesson is, be wise with your finances. Unfortunately, the keys to financial prosperity are far less emphasized and talked about in pop culture than the shallow blessings of materialism.

February 22nd, 2024 at 3:35 PM ^

I don't know if sad is the right word, but its definitely something. Like, if he had just put 5 of that 100 away in a money market, CD, index fund, etc, he would be fine and he could have still blown 95 million!!! I know people that do this don't think like that, but the NFL should do better. I've heard they at least try a bit, but man.

February 22nd, 2024 at 3:39 PM ^

I wonder if anyone ever discussed a forty year plan with him.

February 22nd, 2024 at 3:42 PM ^

It absolutely blows my mind when I do the math on what these guys earn vs what they have left when it ends. Anybody spending more than five years in the league should be reasonably set for life by simply underspending their income and not using it to fund short-term nonsense.

I simply cant get my head around knowing I've got a VERY short, but very high, earning cycle (2-10 years at the most) and NOT banking most of what I make. Spending wildly when you absolutely know the party is going to end much sooner for you than everyone else is borderline insanity and yet they continue to do it, over and over again.

I dont get it.

February 22nd, 2024 at 3:50 PM ^

I would say it is very hard to have the 30,000-foot view when one is literally fighting in the mud. We know. They know. But not easy to keep the perspective.

At this point in my career (hopefully, around the mid-point), I wish I saved more when I started and I wish I started working earlier (grad school, too long). But that perspective wasn't there while I was doing my research or just getting started.

February 22nd, 2024 at 4:07 PM ^

Agree, see my post above. Dude could have put 5mil away and blew 95 if he wanted and still be fine, but he couldn't even do that. These people don't look past 30 seconds, let alone 30 years though. Every time these guys are interviewed, they basically say they had no concept of money at all and just thought it would always be there no matter what. Its so unbelievably stupid, but it happens all the time.

February 22nd, 2024 at 4:12 PM ^

Blows my mind that these guys spend their money like this is going to be consistent paycheck over a 40 year career. Pretty much everyone is out of the league by 35 and then no more paychecks. I have a hard time being sympathetic to guys who end up like this

February 22nd, 2024 at 4:23 PM ^

Have you seen all the music videos out there with the artists talking about wanting to be a billionaire (I'm actually glad that I don't know enough to point you to a specific one) and holding wads of $100's like they're fanned out playing cards? That's what kids are growing up with these days. That's the goal -- extreme wealth and consumption.

February 23rd, 2024 at 12:23 AM ^

Some come from backgrounds where they are the first to go to college. Some come from desperation. When you have no role modeling or experience in your family on actually not living paycheck or from poor means it's not going to click for you organically.

Most on this blog i assume come from at least a middle class background. It ain't like that for a lot of football players. Hard to put us in those shoes.

Education man. I thought i read NFL at least tries some financial literacy requirement a few years back for rookies but I could be wrong.

February 22nd, 2024 at 3:52 PM ^

I actually heard about this while switching through radio stations after a meeting today. It sounds like a fairly comprehensive haul too, anything from what I assume are "around the house" type items to mementos to even trousers. A bit troubling indeed honestly.

February 22nd, 2024 at 6:52 PM ^

Trousers? Fucking trousers? I have no interest in purchasing a pair of Adrian Peterson's pants or even his jeans but I would gladly bid well over asking price for a pair of his trousers.