B1G Expectations - 2019 Preseason

“That was a memorable day to me, for it made great changes in me. But it is the same with any life. Imagine one selected day struck out of it, and think how different its course would have been.”

- Pip (Great Expectations by Charles Dickens)

The 2019 Pre-season Ratings

A long time ago, some metaphysical ass-clowns made the claim that time heals all wounds. What they really meant was that over time, a person’s body (or psyche) regenerates tissue to cover up a wound, but the wound is still there in the form of a scar, sometimes visible, sometimes not. In the best of cases, the sufferer moves on hardened, strengthened and more seasoned from the trauma. November 25, 2018 was just such a trauma for your typical Michigan football fan. Even now, some seven months on - with an additional bowl loss thrown in to demonstrate how it’s possible to lose to the same team twice-over - it can be a struggle at times to ignore the irritating rawness that remains from this most recent infliction of the Wounds of November, which reached heretofore unseen depths of excision. So It Goes.

Yet over the same intervening time, our intrepid and undeterred antihero, Jim Harbaugh, undertook another rigorous course of self reflection and analysis, recognized (once again) the schematic failures that plagued an albeit improved offense, and moved ahead swiftly and unequivocally to make necessary changes and adjustments to address the issues exposed at last season’s ignominious end:

"Michigan defensive line coach Greg Mattison and linebackers coach Al Washington both left to take jobs at Ohio State in early January 2019.[1] Michigan announced the hiring of Josh Gattis as offensive coordinator on January 10.[2] He previously was the wide receivers coach and co-offensive coordinator at Alabama for one season. Head coach Jim Harbaugh also announced the hiring of former Boston College co-defensive coordinator Anthony Campanile as a defensive assistant and former Arizona State assistant Shaun Nua to be the new defensive line coach.[3][4] Assistant head coach and passing game coordinator Pep Hamilton left the team in February. He had been one of the nation's highest paid assistants in 2018."

With this latest re-incarnation of what’s come to be known as Harbaughffense, we bear witness to the emergence of Josh “The Swami of Speed in Space” Gattis, the most innovative shift in UM offensive philosophy since … Rich Rodriguez?

This is not to say Gattis is simply another Johnny-come-lately spread-offense retread. To the contrary, Gattis’ background is as a protegé of the first order when it comes to working with the most modern schemes and tactics in footballdom. Seriously, he cut his OC teeth as one of the co-OC’s that took Bama as far as it could go before committing ritual seppuku in the CFPCG. So it goes. But perhaps the Gattis heritage that is most relevant is that of being an understudy for the Joe Moorehead offense at Penn State. That’s the same offense that leveraged Saquon Barkley’s raw talent with healthy doses of misdirection at the point of attack and downfield stressors that blew the top off Don Brown’s defense - a defense that featured Mo Hurst, Devin Bush, Rashan Gary and Chase Winovich up front. So it goes.

So like life, football goes on, and it’s come time to look ahead to the 2019 season, channel our inner Dorothy Parker, and ask ourselves, “What fresh hell can this be?”

To that end, this diary analyzes some of the preseason Advanced Stats-based ratings for Michigan and the rest of the Big Ten. Most readers are already familiar with the two principal resources that will feed this analysis: Bill Connelly's 2019 S&P+ Early Pre-season Ratings (of FB Outsiders and SBNation FB Study Hall fame) and ESPN's 2019 Football Power Index (FPI) Ratings. The rub with these initial, preseason ratings, both of which came out in early February, is that they apply a completely different set of metrics than do the in-season ratings. The way they differ is that these preseason metrics are leading indicators conceptually, and do not apply any aspect of in-game performance. To elaborate, the S&P+ preseason ratings are derived from the following three components:

- Returning offensive and defensive production (56% weight)

- Recruiting impact (25% weight) is based on 4-year weighted-average of 247Sports Composite recruiting rankings. The weighting (67 percent this year’s class, 15 percent last year’s, 15 percent the year before that, three percent the year before that), which makes the ratings most predictive.

- Recent win-loss history (19% weight, counting 2 to 5 years back, but not including last season)

Similarly, ESPN makes its preseason FPI sausage using three components that are similar to those of S&P+, plus a fourth:

- Returning starters (with special consideration given to a team returning its starting quarterback or gaining a transfer quarterback with experience)

- Recruiting rankings (average rank among 4 systems: ESPN, Scout, Rivals & Phil Steele)

- Prior performance (counting the last 4 seasons, with the greatest emphasis on last season)

- Coaching tenure is primarily a way to capture the addition of a new head coach. With all else equal, a team’s predictive offensive, defensive and special teams ratings will regress slightly to the mean with the addition of a new coach.

In the end, both S&P+ and FPI provide ratings for all 130 FBS division teams, where the final rating is scaled to expected points better (or worse) than the average FBS division team at a neutral site. Simple enough. So without further ado, following is a quick rundown of the pre-season ratings for your 2019 Big Ten football teams.

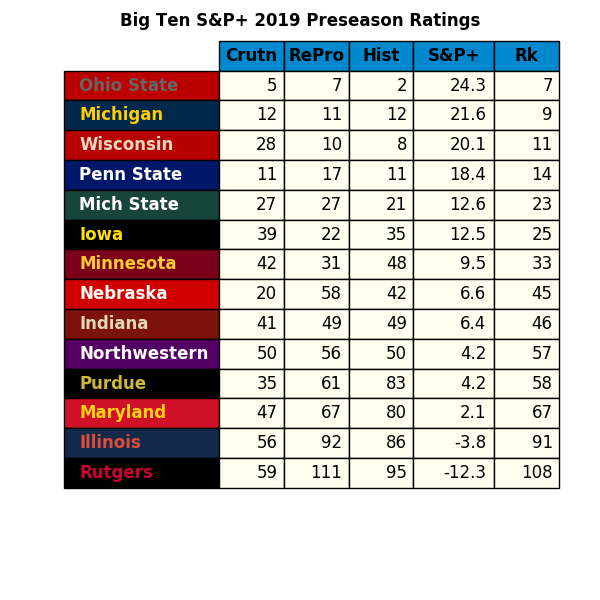

B1G 2019 Preseason Team Ratings

Here we have the first glimpse into what the 2019 season may hold in store, and it’s not half bad! What’s remarkable is that both S&P+ and the FPI have the exact same teams making up the bottom nine, and have them all in the same rank order, beginning with Iowa at #25 in both rankings. Both S&P+ and FPI show only two B1G teams with below average (negative) ratings: Illinois and LOLRutgerz. As for the top five teams, it’s the usual suspects, with all ranked #23 or higher. Also remarkable is that none of them has the same rank order (or ranking) in both S&P+ and FPI. Indeed, the rank orders of 3 of the top 5 teams (Ohio State, Penn State and Wisconsin) differ by two spots. That said, the differences in ratings for UM, Sparty and Penn State are only 0.6, 1.2 and 3.0 points, respectively. However, for Wisconsin and Ohio State, the differences stand at 9.2 and 10.5 points, respectively. It’s these huge shifts that really mix things up in the top five, which all suggests one thing. As Bette Davis once said, “Fasten your seatbelts. It’s going to be bumpy night!”

Note: there’s a special eye-candy bonus for those who hang on to watch the entire clip.

Schedules Matter … Big Time

At this point, a basic approach might be to just pull out the Big Ten teams and look at their respective ratings as given in the tables above. Those more foolish than you might jump to the conclusion that the team with the highest rating would be expected to win its division and the conference. However, as Lee Corso might say, “Not so fast, my friend.” We all know by now, in the wake of the B1G sticking with a 9-game conference schedule, that not all schedules are created equal, and that some provide more advantageous paths of glory than others. This is not just because of the inter-divisional opponents drawn, but also because half the teams play 5 home conference games while the other half play only 4. That’s a 6-point year-to-year swing based on the scheduling construct alone.

Thus, next step is to evaluate each team's schedule and respective matchups, and determine the point spreads therein using the S&P+ or FPI ratings, adjusting for whether games are played at home or on the road. Simple enough. So then, let’s just sum up the wins and losses and have a look at the final standings. After working out tie-breakers, determining which teams should be meeting in the Big Ten Championship Game is relatively straight-forward. As a bonus, since the ratings of each team have already been scraped up, let’s just calculate the average rating of each team’s opponents, rank order them, and call it something like the Quick-and-Dirty Strength of Schedule (SoS) while we’re at it.

Final Standings, Projected from S&P+ Ratings

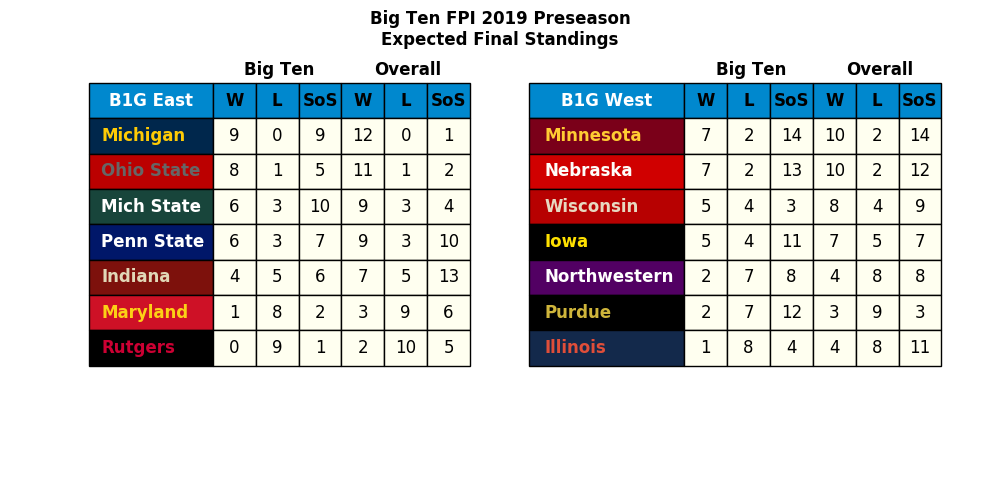

Final Standings, Projected from FPI Ratings

Well, isn’t this interesting? Who would have thought from just looking at the rankings that Michigan would be expected to finish atop the B1G East by both FPI and S&P+. What a difference a year makes. How could this be? Well for starters, this time around, Michigan plays two of its three strongest divisional opponents at home (plus Notre Dame). Granted, UM only has 4 conference home games, but they’re the ones that count the most, with its two toughest road games going against PSU and Wisconsin. As a result, UM’s in-conference schedule difficulty is relatively low, yet UM maintains the most difficult schedule in the B1G overall once the OOC segment is factored in. So, all of this taken together should bode well for Michigan maintaining a place in the CFB Playoff discussion if it can just manage to take care of business.

Pulling up in second place in the B1G East projected standings in both FPI and S&P+ is OSU, who this time around is on the losing end of the first-place head-to-head tie-breaker with Michigan when it comes to the S&P+ standings. Meanwhile MSU and PSU swap the 3rd and 4th place B1G East spots; MSU by virtue of the head-to-head tiebreaker as projected by the FPI ratings. The bottom feeders projected by both S&P+ and FPI are match up with Indiana followed by Maryland and Rutgers.

If anything can be said in comparing the S&P+ and FPI ratings for the B1G West, it’s that there is a nearly complete lack of consensus. Except for agreeing that Illinois is at the bottom, no other team in the division holds the same ranking within the division. In fact, with the exception of Northwestern, all teams differ by two or more places in the standings, with perhaps the most surprising result being that FPI projects Minnesota to top the B1GW by virtue of a head-to-head tie-breaker with Nebraska. One of the keys to these results is that Wisconsin has the most difficult in-conference schedule in the division (#3), while Minnesota has the easiest in the conference (#14). S&P+ sees the schedule difficulties in the same way, but still projects Wisconsin to be on top despite drawing Michigan, Ohio State and Michigan State as its inter-divisional opponents. Clearly, Wisconsin’s schedule woes will make the margins very thin in the B1GW, and so if nothing else, chaos will reign supreme.

Turning Spreads Into Likelihoods

The next step then is to map the point spread into odds, or better yet, the percent likelihood of each opponent to win, with a 0-point spread being the logical (if not statistically validated), 50/50 boundary condition. Back in 2015, Daniel Griffith, a MiniTab Blog contributor, posted a tidy statistical analysis of the differences between the point spreads and actual results for all NCAA games from 2000 through 2014. Suffice it to say, the distribution of differences was found to be Normal with an essentially zero mean (if it isn't zero-mean, then the bookies aren't doing their jobs, yo!). Knowing a formula or two about the characteristics of a Normal Distribution, one can then compute the probability that an actual result is greater (or less) than the point spread.

Just as an aside, the most interesting point from the Griffith analysis is the following (which bears repeating even if you’ve read this before) in regard to the distribution of differences:

"The standard deviation ... is 15.5 points. That means that if a game shows a spread for your favorite team of -3 points, the outcome could be with high confidence within plus or minus 2 standard deviations of the point estimate, which is -3 ± 31 points in this case. So your favorite team could win by 34 points, or lose by 28!"

That, dear reader, is why they play the games.

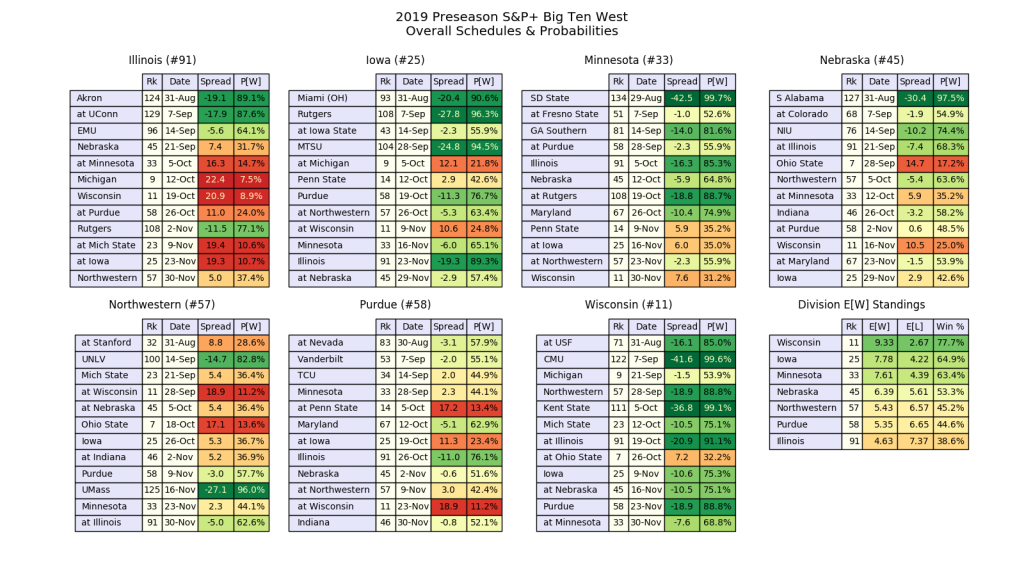

The following four tables of tables show the overall schedules for each team in the B1G East & West divisions, including the S&P+ ratings-based point spreads and attendant win probability (links to the in-conference results are also provided below). A green-yellow-red pseudo-colormap is also applied to quickly give a qualitative indication of where each team faces its greatest challenges, how those challenges stack up, and by comparison, which teams have a more or less difficult row to hoe. Green indicates a favorable point spread; yellow, a competitive matchup; and red, an unfavorable margin. The last table simply shows a rank-ordering of the divisional teams based on their expected in-conference win totals - it’s not a projection of conference standings based on projected wins, losses and tie-breakers.

The B1G East Schedule Likelihoods

S&P+ Results

FPI Results

The B1G West Schedule Likelihoods

S&P+ Results

FPI Results

Total Win Probabilities

After computing projected win probabilities for all the games in each team's schedule based on the ratings-based point spreads (including a +3 point rating adjustment for the home team), it's possible to compute the distribution of total expected wins at the end of the season. The one vagary in this analysis is in regard to FCS opponents. Since neither S&P+ nor FPI provide ratings for FCS teams, I've taken the liberty of assigning the lowest available rating of -30 and -24 to FCS team, respectively. For 2019, the B1G will be showcasing four games against FCS opponents, up from one game last season. They are as follows:

- 29-Aug: Minnesota vs. South Dakota State

- 31-Aug: Maryland vs. Howard

- 31-Aug: Penn State vs. Idaho

- 7-Sep: Indiana vs. Eastern Illinois

For the sake of comparison, the SEC, whose teams still play only 8 conference games per season, will be featuring 15 FCS games for the 2019 season, which is slightly more than one for each SEC team and 25% of the total OOC games.

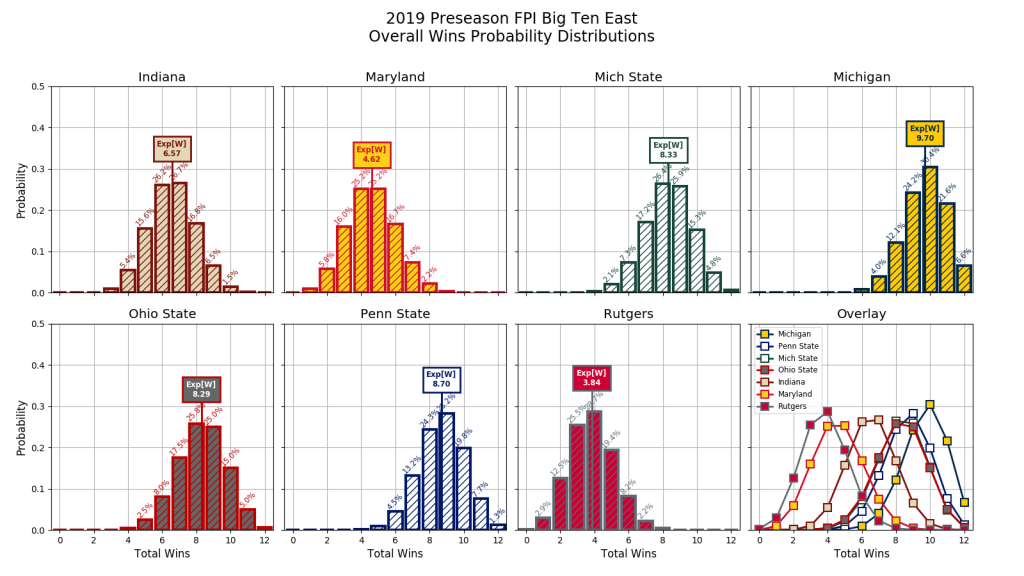

The B1G East Distributions

In the B1G East, the teams can be grouped into four classes: the Contenders (Penn State, Ohio State and Michigan), the Bubble (Michigan State, Indiana) and the Bottom Feeders (Rutgers and Maryland). The Contenders are those teams that by one rating or the other, are shown to be within 2 total expected wins of the top rated team. The Bubble consists of those teams within 2 total expected wins of being bowl-eligible (or not). The Bottom Feeders are the teams with few prospects for gridiron glory or post-season hijinks.

Below are the charts of the overall and in-conference total win distributions for the B1GE based on the S&P+ and FPI ratings, followed by a brief digest of each team’s results.

Overall

S&P+ Results

FPI Results

In-Conference

S&P+ Results

FPI Results

Rutgers

What can be said about LOLRutgerz? OK, how about this: they have a no-traction coach with a faded OSU heritage, a 7-29 record, and a $9M buyout. Ash is literally and figuratively going nowhere. It’s come down to some finger-crossing and hoping that the influx of players appearing through the transfer portal can step up and make good. Given that, prospects are looking a shade better for the Scarlet Knights in 2019, but not enough to pull them out of the cellar, let alone achieve a B1G victory. Basically, they're staring at a 0.5% (S&P+) to 11% (FPI) chance of not having a losing season, including their OOC matchups with UMass and Liberty. Indeed, at least according to S&P+, LOLRutgerz is more likely to go winless (3%) than have a winning season. Their most likely record stands at about 2-10, or somewhere shy of 3 wins (per S&P+) or 4 wins (per FPI). Doing so would double the 2018 win total, but two wins is still a retrograde shift from the 2018 expectations. The Knights are double-digit dogs in seven (FPI) or ten (S&P+) of their games. It still doesn't look like there's any chance that the '14 win over Michigan is going to be dislodged from the Pantheon of LOLRutgerz Classics anytime soon.

Maryland

To its credit, the University of Maryland and its Athletic Department eventually arrived at the only acceptable decision following the saddening death of one of its players last Spring: the removal of Head Coach D.J. Durkin. So it goes. The removal was extended to the remainder of Durkin’s staff when UMd decided not to retain former OC Matt Canada, who had filled in as HC for the 2018 season and carried the Terps to a 5-7 (3-6) record.

So looking ahead to 2019, Maryland is on its way to establishing a new culture with the hire of Head Coach in Mike Locksley, the Broyles Award-winning OC from CFPCG-loser Alabama, and who is also a Washington, DC native. That said, Locksley’s HC experience is not stellar: a 2-26 record with the UNM Lobos, and 1-5 record already with UMd as the interim who filled in after Randy Edsall was terminated mid-season. We shall see…

As for the Terds’ football team prognostications, it looks like another big "meh" as the other Bottom Feeder in the B1G East. Overall, the Terds are only marginally better than LOLRutgerz, with a 26% (FPI) to 31% (S&P+) chance of not having a losing season. Both S&P+ and FPI suggest Maryland will win something shy of 5 games, with its most-likely record being 3-9. The Terds are double-digit dogs in five of their games. Woof!

Indiana

The predictive data indicates that Indiana will continue in its role as the perennial Bubble team, although the Hoosiers may have some competition in the category for 2019. Both S&P+ and FPI suggest Indiana will win something shy of 7 games, with a record of either 6-6 (per S&P+) or 7-5 (per FPI), which puts the Hoosiers in good standing to enjoy some post-season hijinks. Though the Hoosiers are double-digit dogs in 3 of its games, they are also double-digit favorites in 4 of its games. Of the remaining 5 games, the margins are within a single score, and so that is the root of the variance that is the source of the CHAOSTEAM we all know and love. In all, S&P+ gives the Hoosiers a 79% chance of not having a losing season; FPI, an 83% chance.

Michigan State

After Sparty’s lackluster showing in 2018, which saw them stumble to a 7-5 record from 10-2 expectations, it’s looking like expectations won’t be quite so high in 2019. Regression to the mean will see to it that over time, any team will settle into its natural state of being, more or less. Sparty will be in the company of the Hoosiers as they will likely find themselves in a battle for bowl eligibility. Yet, last season’s collapse leaves a lot of room for improvement. S&P+ now gives Sparty a 53% chance of improving its regular season win total from last year, and FPI gives them a 73% chance. As such, Sparty’s most likely record will be 8-4 (per S&P+) or 9-3 (per FPI), which puts them in good standing for bowl eligibility, but on the periphery as far as B1G East Division Title contention goes.

On one hand, FPI is quite bullish on Sparty, which ranks them #14 in all the land. FPI shows has Sparty as a double-digit favorite in 6 games. It’s a double-digit dog in only one game (@UM), and has less than one-score margins in 3 others (@OSU, PSU & @NU).

On the other hand, S&P+ shows Sparty as a double-digit favorite in 5 games. But, it’s also a double-digit dog in 3 games (@OSU, @UW and @UM), and has less than one-score margins in 2 other games (PSU & @NU). S&P+ ranks Sparty at #23.

Penn State

The post-Mooreheadian Era of Penn State has seen the steady decline of the Nits from second banana status in the B1GE to something of a markedly lower grade. PSU’s projected final standings put it at either 3rd or 4th place as per S&P+ and FPI, respectively. PSU’s in-conference win distributions place them in at least one win behind the B1GE leader.

Although the Nits are favored by double-digits in seven of its games according to both S&P+ and FPI, the other five (four) margins are less than one score, with two (or three) of those marking the Nits as underdogs, as per S&P+ (FPI). As such, S&P+ has PSU going 10-2 (7-2) on the season, with FPI showing a bit less love at 9-3 (6-3). What's declined for the Nits is that they are underdogs to UM at home in a white-out and to OSU in the Horseshoe by both ratings this time around. Also as noted above, FPI has the Nits as dogs at Sparty. If the Nits can down the Hawkeyes the preceding week, they'll be flying high and likely undefeated as they return home to Happy Valley to take on the Wolverines, who may be behind the eight ball at that juncture. Statistically, PSU still has a 29% to 33% chance of improving its record over last season's mark (10 wins or more), with a slim 1-2% chance to win’em all. This is founded largely on the strength of its recruiting and recent history (both ranked #11 by S&P+). Despite an expected decline on offense due to the departures of QB Trace McSorely to the NFL and expected 2019 starting QB Tommy Stevens to the transfer portal (Miss. State), it’s worth noting that the PSU defense returns all 11 starters, including Sophomore LB Micah Parsons. To that end, the FPI ratings put PSU’s defense at #8.

a State University in Ohio

Frankly, given the Wolverines’ struggles of the past two decades against the hairless nuts, the end of the Urban Meyer era could not have happened soon enough. So what it if UM never beat the dirty dog. At least he won’t beat UM again. So, time to move on, Amirite?!

Next up is Ryan Day - a harbinger of better things to come for the ol’ Maize’n’Blue? So far at least, Day is off to an inauspicious beginning what with his “steal” of Greg Mattison from UM to be his DC, and the decimation of what had been a stable of competent QB’s. Only time will tell, but yet, this is certainly no reason for UM to take its eternal nemesis even one iota more lightly.

Looking ahead, it appears that for once, aSUO is not favored to win’em all, with both ratings projecting an 11-1 final record. The disparity in perception of aSUO is no more apparent than in their respective number of double-digit margins: S&P+ favors aSUO by 10 or more points in 9 games; FPI, only 5 games. This year, the Hairless Nuts’ toughest matchup will be in The Game in Ann Arbor, where FPI has them as double-digit underdogs (whereas the S&P+ margin is only 0.3 points). In conference, S&P+ shows aSUO with a mode of 7 wins with a strong lean toward 8 wins, with a statistically stronger distribution compared to UM’s. In contrast, FPI has aSUO with a mode of only 6 leaning toward 5 wins, with a distribution that is nearly indistinguishable from MSU’s, a shade weaker than PSU, and a solid 1.5 wins below that of Michigan.

Some heartening statistical observations:

- Chances of tOSU improving on last season (going undefeated): 0-9%.

- Chances of tOSU losing 3 or more games: 31-54%.

- Chances of tOSU having a losing season: 0-3%.

Michigan

Among other things that were lost in the ignominious collapse of Team 139 at season’s end was the opportunity to rekindle the torrid love-affair that was the S&P+ and the first two seasons of Harbaugh's Wolverines. Maybe Team 140 will be the one to win the S&P+ back? For Team 140, the probable record stands at 11-1 (8-1), with modes of 9 (7) wins, as per S&P+. However, FPI sees Michigan going 12-0 (9-0), with modes of 10 (8) wins! Michigan is favored by double-digits in 8 (9) games by S&P+ (FPI), and has margins of less than one score in 4 (or 2) games per S&P+ (or FPI). At this point, only Wisconsin is favored by either rating to beat Michigan. The Badgers are favored at home (by S&P+ only, 1.5 points), making the game in Madison the toughest on the schedule. Once again however, FPI sees the Oct. 19 game at PSU in a Beaver Stadium white-out as Michigan’s toughest - but still favors the Wolverines by 2.6 points. As noted above, UM is favored to edge aSOU as per S&P+, but FPI sees Michigan as a double-digit favorite in The Game!

Here’s another round of heartening statistical observations:

- Chances of a Michigan losing season: vanishingly small.

- Chances of Michigan improving on last season’s win total (11 or more wins): 45-49%.

- Chances of Michigan going undefeated: 16-28%.

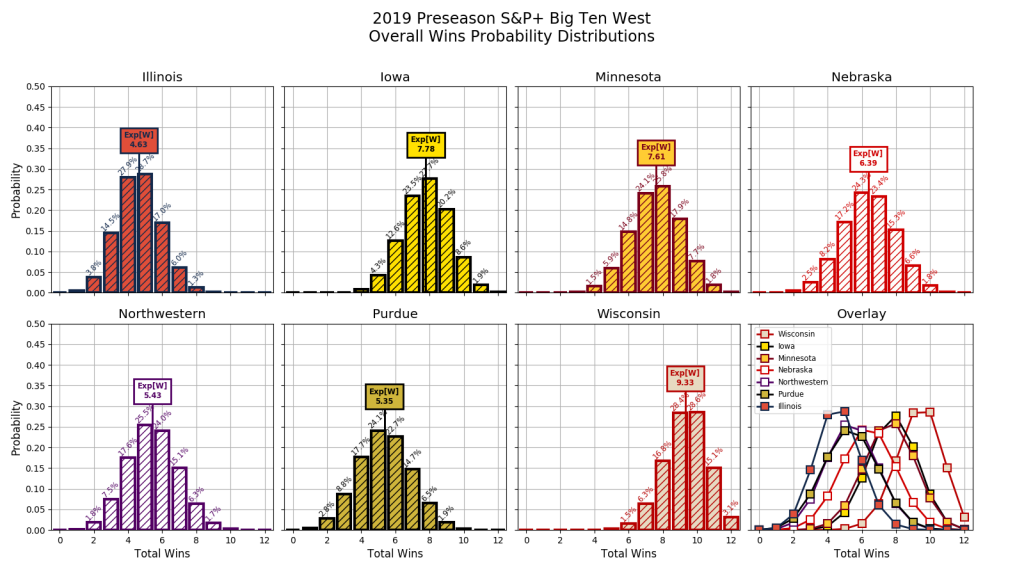

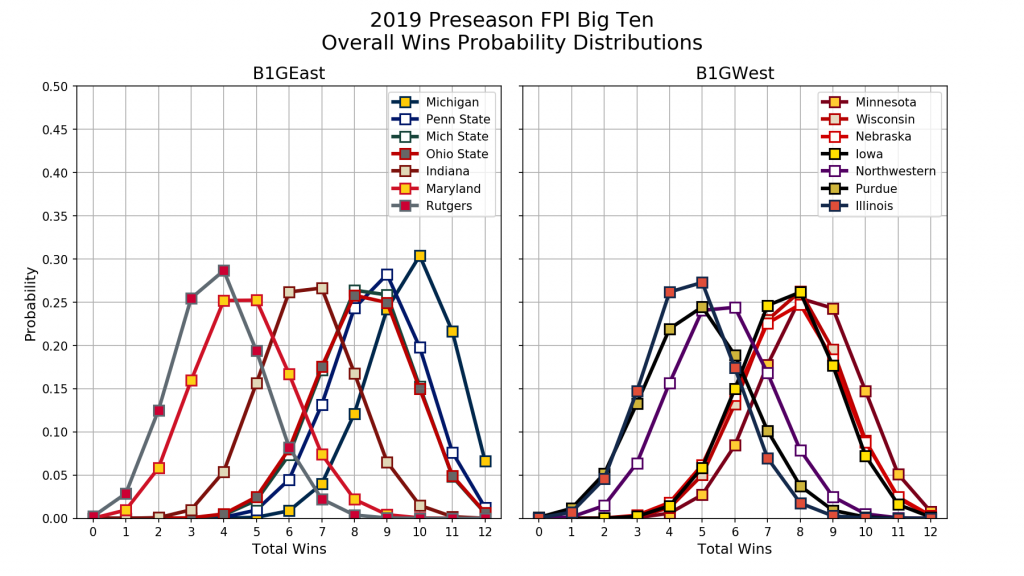

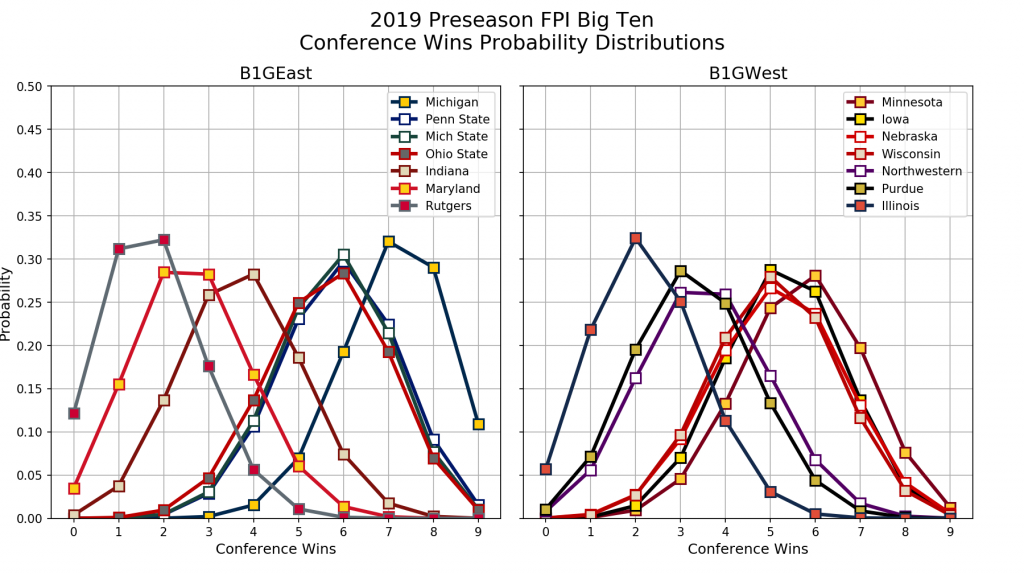

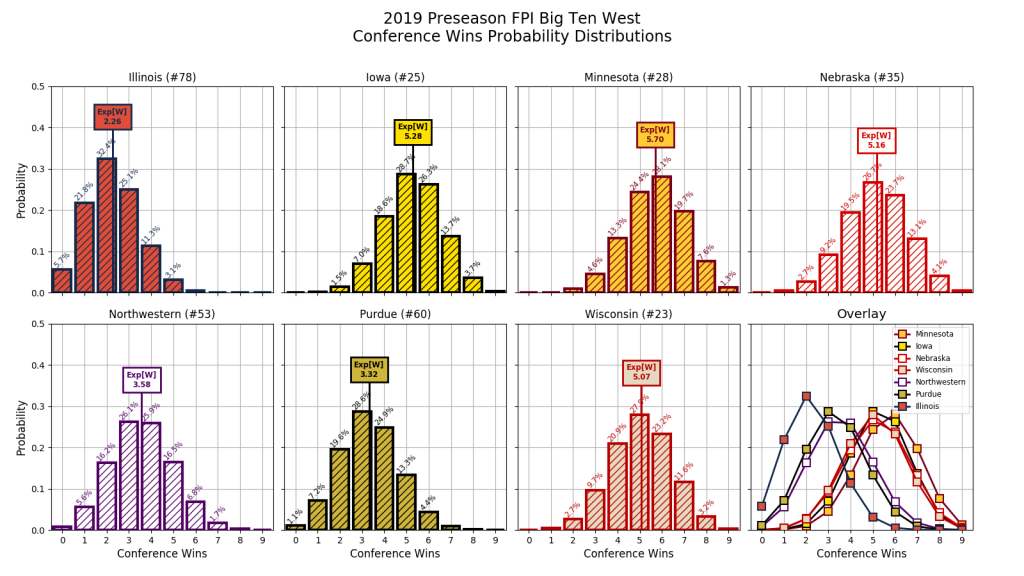

The B1G West Distributions

The 2019 season looks to be another log-jam atop the Big Ten West, with three (four) teams getting classified as Contenders as per S&P+ (FPI) . Of course, Wisconsin is one of them; the others are (as per S&P+): Iowa and Minnesota. FPI adds Nebraska into the mix, with Northwestern lurking just outside the margin. It’s worth noting that Minnesota has the weakest conference Q&DSoS in terms of both ratings, and both Nebraska and Iowa also have very weak (double digits) conference schedules. On the other hand, Wisconsin has the 3rd strongest Q&DSoS per both ratings. is actually Iowa largely by virtue of their weak Q&DSoS. The B1GW Bubble is burgeoning with the remaining teams: Nebraska Northwestern, Purdue - with the Huskers being the strongest candidate to become bowl-eligible. Both ratings still relegate Illinois to the Bottom Feeders class, picking up from where they were left for dead last season to carry on like zombies looking for something to bite.

Below are the charts of the overall and in-conference total win distributions for the B1GW based on the S&P+ ratings (with links to the FPI charts), followed by a brief digest of each team’s results.

Overall

S&P+ Results

FPI Results

In-Conference

S&P+ Results

FPI Results

Illinois

Illinois will resume its position as one of the B1G West Bottom Feeders, but the Illini have managed to narrow the separation between them and the rest of the division. Indeed, while S&P+ distributions still show about a half game separation (in terms of mode) compared to the rest of the pack, the FPI distributions show the Illini matching up with the resurgent Boilermakers. Both S&P+ and FPI have the Illini favored in four games this season (including over LOLRutgerz), with three by double-digits (all its OOC games). This is up from only one game as a preseason favorite in 2018. With modes of 5 wins, the Illini have a 25% chance of getting to at least 6 wins and Bowl Eligibility, which would be a major breakthrough for Lovie Smith and his crew. Of course, the other side of that coin is that the Illini have 75% chance of having a losing season.

Purdue

Things are supposedly inching upward for Purdue under now 3rd-year coach Jeff Brohm. Yet, the distributions suggest the end results may be retrograde. It’s looking as though it may be a struggle to qualify for a bowl game for a 3rd year in a row, making the Boilers a Bottom Feeder in 2019. S&P+ and FPI both show most likely records of 6-6 (4-5) and 3-9 (2-7), respectively. That’s what having two Power 5 - and no FCS - teams on the schedule does for you if you’re a bottom feeder. Yet, the Boilers have modes of 5 wins according to both ratings. They’re chances of avoiding a losing season range from 33% to 46%, with the chances of going completely winless negligibly small. The main thing working against Purdue is their schedule, which overall is either the second or third strongest in the B1G, but that's the sort of thing that gets a Bubble team into a bowl game.

Northwestern

Last year’s B1GW Champions and perennial Bubble Team, Northwestern, look to go a bit futher in 2019 with the “rope-a-dope” strategy it used in 2018, by starting out from a pre-season position that is disguised as a Bottom Feeder, albeit, the team most likely to break out of the bottom. Both S&P+ and FPI forecast a most likely record of 4-8 (2-7), but with modes of 5 and 6 wins, which sounds more like a Bubble Team. In the aggregate, these numbers suggest a continued retrograde move from the 10 win result of the 2017 season. What's more is that in a setup very similar to 2018, the Cats are going to be facing a lot of tight matchups in 2019. Indeed, both ratings show NU having 8 games with margins of less than 10 points! Either way, the Wildcats have a 47-52% likelihood of becoming bowl-eligible. So the Cats might eat the bear, or the bear might eat the Cats.

Nebraska

Next in the B1GW Bubble are the Cornhuskers, who after implanting new coach and savior, Scott Frost and sleeping through the first half of the 2018 season, are now creeping into contention for the B1GW. At least,that’s what the FPI margins suggest when it projects a 10-2 (7-2) record with a mode of 8 wins overall, putting them into a tie for first place in the B1GW. Meanwhile, the S&P+ margins are deploying the drag parachutes on the Husker Death Harvester, projecting a more modest 7-5 (4-5) with a mode of 6 wins overall. As such, S&P+ still gives the Huskers a 72% chance of reaching bowl eligibility whereas FPI gives the Huskers a 92% chance. Either way, the Huskers are looking like a lock for postseason play, and will be a major factor in determining which team represents the B1GW in the B1GCG, if not doing it themselves!

Iowa

Iowa also looks to contend for the B1GW. S&P+ projects the Hawkeyes to have a 9-3 (6-3) final record; the FPI, 7-5 (5-4). Either way, that’s within two wins of the first place team, whoever that might be. Regardless, both ratings put the Hawks' mode at 8 wins overall and 5 wins in conference, which at the end of the day could be enough to win the B1GW in a tie-breaker - which is probably the Hawkeyes’ best hope for a return to Indy. Similar to Northwestern, Iowa has 8 games (per S&P+, 7 per FPI) with margins of less than two scores. Suffice it to say, the team with the most consistency in its two ratings is Iowa. It’s all of the other contenders that fluctuate about the central mean that is Iowa.

Wisconsin

What goes around comes around, and what’s come around for the Badgers this year is one of their tougher schedules in recent memory. Despite drawing Michigan, Michigan State and Ohio State as their inter-divisional matchups, they play in the B1GW and have 5 B1G home games as well. So, the Badgers have only the 3 strongest conference schedules in the B1G (behind UM and aSUO). When you're the only top tier team in the B1GW, that's pretty much par for the course, except when you’re not. Such is the difference between this year’s ratings. S&P+ projects the Badgers’ most likely record to be 11-1 (8-1) with a mode of 10 wins, good enough to secure an invite to Indy with a couple of games to spare! Yet to the contrary, FPI claims, “Not so fast, my friend!” The Badgers have 6 games within single-digit margins and are only good enough for an 8-4 (5-4) record with a mode of 8 wins. Indeed, it has 3 matchups of with margins less than two points: Michigan State, Nebraska and Minnesota. So much for a couple of games to throw away. Even so, the Badgers still remain in contention for an invite to Indy, it’s just that it promises to be a long and difficult road, a road fraught with peril...

Some noteworthy statistical observations:

- Chances of Bucky going undefeated: 0-3%.

- Chances of Bucky losing 3 or more games: 53%-89%.

- Chances of Bucky having a losing season: 0-6%.

Minnesota

Last but not least are the Golden Boat-Rowers of Minnesota, who after countless hours of oarsmanship can finally stake a claim to B1GW Excellence on the basis of having not only the weakest conference schedule, but also the weakest overall schedule in the entire B1G (as per both S&P+ and FPI!) Nonetheless, Minny is still two games behind UW in the S&P+ distributions - with a nearly identical characteristic as Iowa - and a predicted final record of 9-3 (6-3) with a mode of 8 wins (5 in the B1G). Nonetheless, the FPI distributions put the Boat-Rowers at the top of the heap, seizing an invite to Indy by virtue of a tie-breaker with the Huskers. The big caveat - as per both ratings - is as with so many other B1GW teams: Minny has 7 games with single-digit margins, and 6 games that are within one score! P.J. Fleck’s investment last season in a Freshman walk-on as the starting QB may pay big dividends in 2019, especially if it comes down to having a QB with some experience in pressure situations. B1GCG invite or not, S&P+ gives the Oarsmen a 93% chance at bowl eligibility and FPI, a 97% chance – which is quite impressive.

Overlay Redux

Just to wrap things up with a quick visual summary, here are the combined overlays of the total wins probabilities broken out by division.

S&P+ Overall

S&P+ In-Conference

FPI Overall

FPI In-Conference

So there you have it, another pass at preseason prognostications of future outcomes is in the record. Statistics can be a mind-bending, counter-intuitive thing for sure, the analysis of which is only as good as the data that goes into. “Garbage in, garbage out” is often said - and anyone can rattle on until their blue-in-the-face as to the merits of metrics, or lack thereof. To that end, it’s worth noting that much like the teams being rated, the metrics that contribute to this analysis have not remained static over the years. They are constantly adjusted and tweaked by the respective analysts to improve their correlation with past results. But now, it’s time to play the games and determine the next round or real outcomes.

In the end, if a team can in reality win the games it’s expected to win, and if that same team can also win the games in which it has a competitive chance, then that team will have realized its full potential, full stop. Those are some pretty big “ifs” for any football team of course. Yet, if such a team is indeed expected to win most of its games, and has a competitive chance in all its other games, and if that team can believe in each other… not criticize each other or talk about each other … and encourage each other, then when they play as a team, when the old season is over, you and I know, it’s gonna be Michigan again. Michigan!

Yours in football, and Go Blue!

August 24th, 2019 at 4:45 PM ^

Love it. Thanks for the detailed analysis and breakdown across the B1G.

August 24th, 2019 at 5:04 PM ^

Impressive statistical summary, and many thanks for your hard work. If we didn't have to play the games, we could claim the (hypothetical?) championship, but what would be the fun in that?

Much more enjoyable to watch it happen on the field.

Provided we win, of course. (Think 1997 . . . .)

Go Blue!

August 24th, 2019 at 5:28 PM ^

I totally forgot about the Mattison move. F that guy. Seriously. I don't care how you slice it, going to THE osu was him giving us (and likely Harbaugh) the finger. Now I'm pissed.

August 24th, 2019 at 5:58 PM ^

Great breakdown. Thanks!

August 24th, 2019 at 6:55 PM ^

Prediction for Big Ten football as a whole: a season of ugly-ass play with glimpses of quality dispersed within it. Still worth every minute.

August 25th, 2019 at 12:25 AM ^

If we were going to lose a game, I'd rather it be @ WI then @ PSU. I'm counting on Michigan beating MSU, ND and OSU at home. The odds of going undefeated are quite low IMO. I'm always hopeful at the beginning of a season but late October and November BPONE seems to settle in.

August 25th, 2019 at 7:01 PM ^

Yes, especially with the potential rematch in the B1G.

Revenging an early season loss isn't going to keep Michigan out of playoff contention, though it seems a bit early to talk playoffs. Still, things appear to be coming together.

August 25th, 2019 at 11:18 AM ^

What's with the weak OOC scheduling for OSU and Wisconsin? Pretty much everybody else in the conference scheduled at least one other P5 non-conference opponent, and the best OSU and Wisconsin could get was USF and Cincinnati? I guess they both have tough crossover games (Wisconsin plays UM, MSU, and OSU; OSU plays Wisconsin, Northwestern, and Nebraska), but still! Those have to be two of the weaker OOC schedules of anyone in the top 25.

August 25th, 2019 at 12:29 PM ^

Hard to rag on OSU for having a blip without a premier opponent. They just wrapped up series with Virginia Tech (14 and 15) and Oklahoma (16 and 17) and have upcoming home and homes with Oregon (20 and 21), Notre Dame (22 and 23), Washington (24 and 25), and Texas (25 and 26). There's plenty of reasons to hate the Buckeyes, but being afraid to schedule OOC is not really one of them.

August 25th, 2019 at 2:28 PM ^

Yeah completely agree-- that is why their 2019 schedule was suprising. "They usually schedule one tough OOC game" doesn't contradict the statement that their schedule this year is exceptionally weak. There are only 5 top 25 teams that don't play an OOC game against a Power 5 school (or Notre Dame)-- OSU, Wisconsin, Utah, Washington, and Washington State. So past and future scheduling aside, I still think it's weird that OSU has such a weak OOC schedule.

August 26th, 2019 at 2:35 PM ^

2019 was intended to be the back end of a home-&-home with TCU. But TCU weaseled out of the 2nd game and got it to be a one-game series on a "neutral" site (@ JerryWorld, just a few miles from campus).

So aSUO had to desperately find another opponent, thus added Miami (NTM). Otherwise, TCU would have again been aSUO's marquee non-con matchup.

August 25th, 2019 at 3:08 PM ^

Nice work I think it’s us and the Buggeaters in the BTNCG

August 25th, 2019 at 5:23 PM ^

Really well written and enjoyable post: thanks op!

I worry that MSU is having their signature disrespekt year. I think the computers may be underselling them a bit. They only need a marginal offense to be an 8 win team.

As for our boys in blue, the computers certainly are in line with Michigan’s historical trend. I just hope we don’t get to November thinking, ‘what if...’ as we have so many years past.

go blue!

August 26th, 2019 at 7:38 AM ^

We are a 10-2 team until we can prove otherwise.

August 26th, 2019 at 11:22 AM ^

My favorite Michigan -Ohio State game was when Woody tore up the sideline makers after a Michigan interception. Refs should have thrown him out of the game. How many of our bloggers remember seeing that?

August 26th, 2019 at 2:39 PM ^

As I wiggle my evil, mystical fingers toward you: "You're feeling very comfortable. You're beginning to like the way things appear. You feel good about yourselves. Everything will be different this season. It has to turn your way sometime. This is going to be the year. Feel good about yourselves. Yes, you're feeling happy. Very, very happy. Nothing could possibly go wrong."

/hypnotic trance

August 27th, 2019 at 12:44 PM ^

Way too excellent. TLBIFLISPTR (too long, but I felt like I should pretend to read).

Do we win? TLDR: Yes!

August 27th, 2019 at 5:25 PM ^

Good work. One thing I'm wondering though is how do last year's predictions compare to results? That is, how much should I believe these predictions? And is one system superior to the other? Are the formulas and their associated weighting appropriate for predicting success?

It's a lot to ask but If you find yourself with some time on your hands I'd be interested in reading a diary about how previous season predictions have turned out, and since you've done one every week in the past I wonder if there's a relatively early week where predictions become nearly locked in, i.e. how you play in the first game against a P5 opponent determines how your season is going to go.

Comments